Tips for Crypto Gambling: Basic Math

Knowing Chances and How to Manage Risk

To do well in crypto gambling, one must learn math rules and stats ways. It starts with using the Kelly Criterion formula: f* = (bp – q) / b, which helps use money right to grow it over time. Expert traders keep trade sizes no more than 2% of all money to stop big money losses.

Win Rates and Risk vs. Reward

Tracking stats for at least 100 trades shows key info. A good plan keeps at least a 1:2 risk-reward ratio. With a 40% win rate, traders need at least a 1:1.5 ratio to keep making money. Games like Bitcoin dice usually have a 1% edge for the house. 여기서 안전성 확인하기

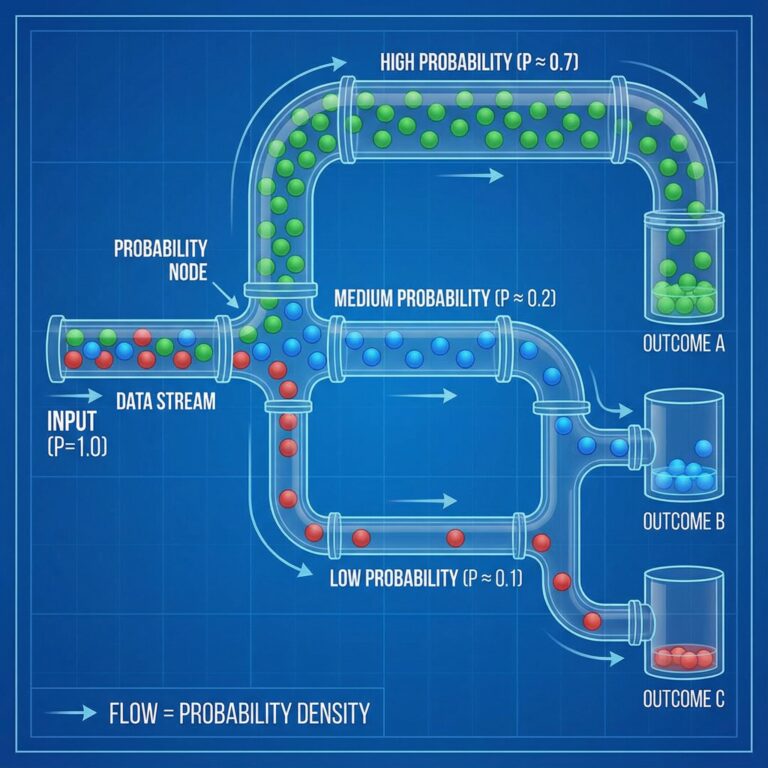

Using Probability in Real Games

Knowing real randomness matters – past results don’t change what will happen next. This key idea of chance helps dodge usual gambling mistakes. Winning needs using math advantages like:

- Smart money control

- Steady trade sizes

- Analyzing results with stats

- Calculating rewards adjusted for risk

Building a Math Edge

To build a stats edge, blend many math ideas:

- Kelly Criterion use

- Analyzing win rates

- Figuring out house edges

- Looking at risk-reward ratios

These parts make a plan for strong crypto gambling methods backed by math chance.

Knowing House Edge in Crypto Gambling

The house edge shows the casino’s math advantage over players, in percent per bet.

Main House Edge Parts

Two keys figure out house edge:

- Real odds: The true math chance of winning

- Payout odds: The winnings ratio given to players

How to Work Out House Edge

Simple House Edge Method

House Edge = (Casino’s Expected Profit / Player’s Total Bet) × 100

Sample Work Out

In a coin flip game in crypto offering 1.9:1 payout on true 2:1 odds:

- Expected Value: -0.05

- Bet Size: 1

- House Edge: 5%

House Edge Range in Crypto Gambling

Usual House Edge Percentages

- Bitcoin Dice: 1% house edge

- Crypto Slots: 5% house edge

- Best Range: Below 2%

- High Risk Range: Over 4%

How It Changes Money Manage

The house edge percent affects how long money lasts.

A small 1% change in house edge can really change how long you can play

Lower house edges let you play longer and might give better money back rates.

Picking Games Smartly

Choose games with low house edges to try for better returns.

Pick crypto gambling with house edges under 2% for the best chance to keep your money and possibly win more. Momentum at the Break of Morning

Chance Ideas in Crypto Games

Randomness, freedom, and expected value are at the heart of what happens in crypto gambling. These rules control each play and betting move in the crypto game world.

Real Randomness in Game

Real randomness means old results don’t affect what comes next. Every crypto bet is its own thing, no matter what happened before.

Even if a player loses or wins 10 times in a row, the chance for the next bet doesn’t change.

The Rule of Being Independent

Independence is a key in how crypto gambling works. Each game – a dice roll, roulette spin, or card deal – is its own thing.

Thinking that chances must “even out” over time is a gambler’s mistake. What happened before can’t change what will happen.

Expected Value: The Math Base

Expected value (EV) is how you check if bets are good. This math work looks at:

- Every possible result times its chance

- Adding all results

- Figuring out long-term money making

For example, a dice game in crypto with a 98% Return to Player has an EV of -0.02 per bet. This negative expected value means losses over time, as no betting plan can beat this math downside.

Deciding with Chance

Knowing these chance basics helps make smart crypto gambling choices. Players should see that math rules, not guessing or betting ways, set what happens in crypto game parts.

Best Money Manage Plans

Best Money Boss Plans for Crypto Trading

Key Plans for Crypto Money Manage

The Kelly Criterion is the math base for smart crypto money manage:

f* = (bp – q) / b

- f* = right part to bet

- b = net odds you get

- p = chance to win

- q = chance to lose

Rules to Handle Risk

Sizing Trades

Use a top 2% rule for how big individual trades can be:

Max Trade = Total Money × 0.02

This careful way helps guard against market ups and downs and keeps your money plan strong.

Using Stop-Loss

Use this for daily risk limits:

Daily Loss Limit = Monthly Money × 0.1

Stronger Risk Handle Ways

Mix these math plans to make a strong trading system:

- Kelly Criterion for how big to trade

- 2% max rule for trades

- Daily stop-loss limits

- Controls on trade sizes

This math method makes the most of expected values while keeping crypto safe with exact risk handling. Ion-Ridge Blackjack: Harnessing

The plan keeps your money safe over time by keeping strict trade limits and using smart loss stops.

Looking at Betting Ways

Studying Betting Ways: A Data Plan

Basics of Pattern Checking

Pattern checking is the stats base for good trading and betting plans.

Full data tracking of keys like win rate percents, bet size making the best, and money back (ROI) shows if a strategy really works.

With good checking, traders can tell apart truly good ways and random stat changes.

Must-Have Measures for Recognizing Patterns

Statistical meaning needs checking a dataset of at least 1,000 betting events. This number lets you rightly figure out key measures like how spread out results are and how changes differ (CV).

A CV over 0.5 points to high-risk patterns that need a change in strategy.

Key Measures for Success

Three key measures drive good pattern checking:

- Win/loss counts

- Trade sizes (best range: 1-3% of money)

- Keeping track of total money back

Advanced Pattern Checking Plan

Use careful checking with these points:

- Watch money back for 100+ betting events

- Keep trade sizes steady

- Think again about your plan if money back goes below -5%

- Check how market pairs link

- Find market spots for making money

With strong use of these checking ways, traders can make firm, data-driven plans that use clear market patterns.

Basics of Risk vs. Return

Knowing Risk vs. Return in Crypto Trading

Figuring Risk vs. Return

Risk-return checking is key for a money-making crypto trading plan.

The work out splits possible money gain by top risk per trade. For instance, a 0.1 BTC stake with 0.3 BTC possible gain makes a 1:3 risk-return ratio.

Best Ratio Targets

Good crypto trading needs keeping at least 1:2 risk-return ratios, with 1:3 or more being safer for your money.

These ratios must match chance to win numbers – having a 40% win rate needs at least a 1:1.5 ratio for staying in the game.

Expected Value Work Out

Expected value (EV) mixes risk-return ratios with chances to win. Multiply the ratio by the estimated chance to win to find money-making chances.

A 1:4 risk-return ratio with a 30% chance to win gives +0.2 EV, showing a math advantage. Stay away from negative EV, no matter the possible gains, as they’re sure to lead to long-term losses.

Key Risk Handle Points

- Watch risk-return ratios all the time

- Work out expected value before trades

- Keep trade sizes right relative to your money

- Check win chances in different market spots

Linking these measures forms a strong plan for lasting wins in crypto trading.